The Ultimate Ichimoku Course consists of 11 video lessons that guide the trader through the journey of learning the basic skills needed to implement the Ichimoku Cloud into their trading strategy.

The course begins with a brief introduction, where Rafał introduces himself and the history of the Ichimoku Cloud. The 10-lesson course then covers the five lines of the Ichimoku indicator, their purpose and use, as well as the three theories that are crucial for a proper understanding of Ichimoku.

Below is a list of the 11 videos available in this course:

- Introduction and Overview of the Course

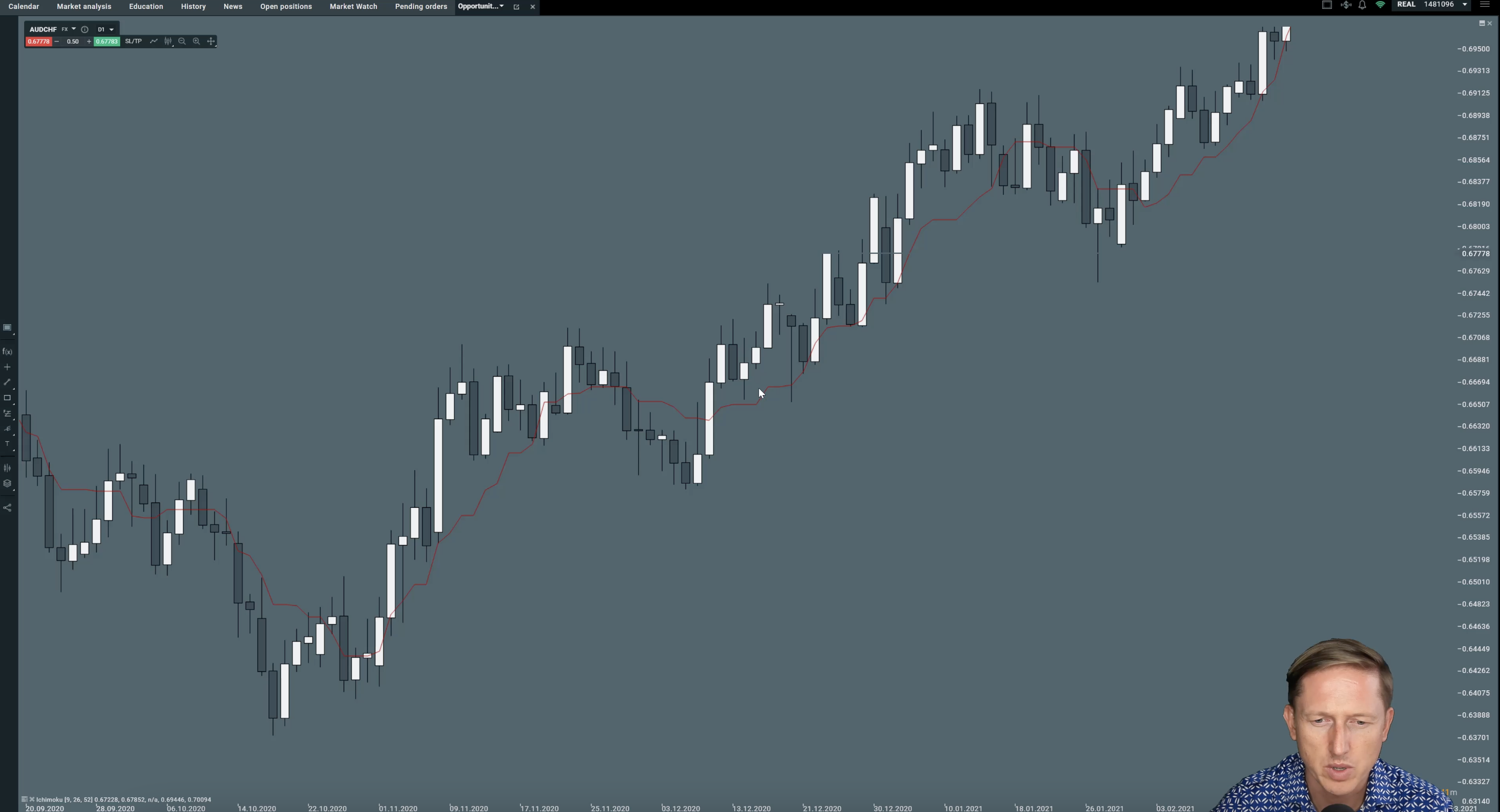

- Applying the Ichimoku Indicator

- Tenkan-Sen

- Kijun-Sen

- Chikō-Span

- Leading Spans

- Price Theory Targets

- Wave Theory

- Time Theory

- Wave, Price, Time: Let's put everything together

- Creating Trade Ideas on a Live Market

This very comprehensive course is available for free to all XTB customers.

The introduction plus a sneak peak into how to apply the indicator and a lesson on Tenkan-sen are now also available to all holders of our free demo account.